Adviser

MassMutual Investments provides value-added solutions to help successful financial professionals enhance and grow their practice.

MassMutual Investments provides value-added solutions to help successful financial professionals enhance and grow their practice.

Being a financial professional is more complex than ever, adding additional demands on financial professionals like you. That is what MassMutual Investments can help you with. We leverage some of the leading resources, research and tools in the industry to help you increase client engagement, deliver greater value ...and enhance and grow your practice. We look to find resources you can use right away.

Your role as a fiduciary is evolving. DOL, IRS and SEC rules keep changing and need a trusted resource for current information shaping today’s trends. Plan sponsors are increasingly wanting more than mere oversight of their investments. Critical to elevate your services to plan sponsors.

A key MassMutual Investments resource is PlanChampion, our comprehensive practice management program designed to exclusively to help retirement plan advisers. The approach with the end in mind, ensuring that you receive support where it matters most: in winning new business and expanding your existing plan sponsor relationships.

The PlanChampion program addresses the challenges you face by delivering targeted solutions through every step of your client relationships:

We provide customized, targeted lists to help make your prospecting efforts more efficient and effective in driving awareness of your firm. Ongoing guidance optimizes your targeting efforts.

We help you enhance interest and prepare for prospect meetings by refining and articulating your value proposition, conducting needs assessments and delivering detailed prospect insights.

We provide a plan and know-how that can ensure you’ll always come from a place of strength and are prepared for meetings and presentations with plan sponsors.

While you manage the client relationship, PlanChampion partners help with the preparation and understanding to close the deal and demonstrate the value that you bring.

PlanChampion’s suite of tools, resources and consultations help you deliver outstanding client service throughout the relationship — for you to other prospects.

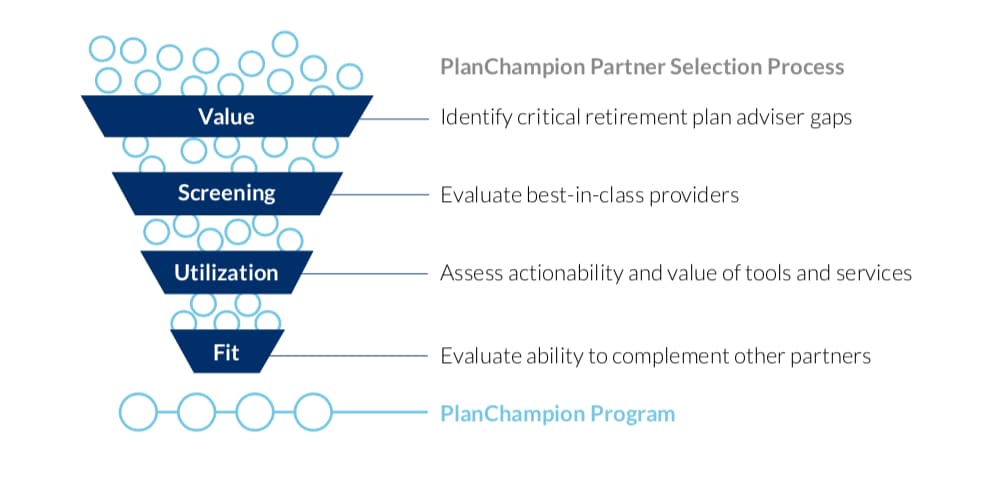

The goal is to find what is considered the best-in-class in providing support. This is why an “open architecture” partnership model was developed, giving you access to unbiased expertise from multiple industry experts. As part of PlanChampion, elements are selected of their respective programs and expertly to drive actionable value to your practice. New partners, tools, and resources are continually reviewed and assessed to further enhance the strength of PlanChampion and address the evolving needs of financial professionals like you.

The Retirement Learning Center (RLC) is the foremost, independent thought leader in the retirement and rollover space. They offer multi dimensional educational and business building solutions.

Fi360 empowers financial intermediaries to use the Prudent Practices® to profitably gather, grow and protect investors’ assets with a fiduciary standard of care.

Through a combination of proprietary, integrated datasets, insight and industry leading platforms, BrightScope helps plan advisers drive growth through more informed, data-driven decision making.

FOR FINANCIAL PROFESSIONALS. NOT FOR USE WITH THE PUBLIC.

*The Retirement Learning Center, Fi360, and BrightScope are not affiliated with MassMutual or any of its subsidiaries.

MassMutual defines plan advisers as the service financial professionals provide to defined contribution plans as fiduciaries under ERISA 3(21) or 3(38) only, even though the financial professional may offer other services outside of their investment advisory role.

All funds carry some level of risk. Before you invest, be sure to read the fund's prospectus and shareholder reports to learn about its investment strategy and the potential risks. Funds with higher rates of return may take risks that are beyond your comfort level and are inconsistent with your financial goals.

Investors should consider funds’ objectives, risks, fees, and expenses carefully before investing. This and other information can be found in the funds’ prospectuses or summary prospectuses, which are available from MassMutual by calling 1-866-444-2601. Please read them carefully before investing.

MassMutual Investments is the marketing name for certain products and/or services of MassMutual and its subsidiaries, including MML Investment Advisers, LLC (MML Advisers). Investment advisory services of MassMutual Investments are provided exclusively by MML Advisers. Principal Underwriter: MML Distributors, LLC. (MMLD), 1295 State St., Springfield, MA 01111. Member FINRA and member SIPC. MMLD and MML Advisers are subsidiaries of MassMutual. ©2025 Massachusetts Mutual Life Insurance Company (MassMutual®), Springfield, MA. All rights reserved. www.MassMutual.com

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE